MSFCP and the National Council for Workforce Education

Due to the success of the Money Smart Forum (MSF) at Westchester Community College (WCC), in 2021, JPMorgan Chase began discussions about replicating the financial coaching program at other colleges. They created a Request for Proposals (RFP) to select an organization to administer an expanded program to include WCC and an additional six community colleges and one historically black college or university (HBCU). Several organizations responded to the RFP and the National Council for Workforce Education (NCWE), led by Executive Director Dr. Darlene G. Miller, was selected to oversee the 3-year Money Smart Financial Coaching Program (MSFCP).

Project director, Dr. Christal M. Albrecht, was hired to manage the day-to-day operations. Suzanne Matthews, who ran the highly successful WCC program, continued her role as lead coach and assistant project director. An additional coach, Juliette Saisselin, joined the team to share the coaching workload, providing guidance to the colleges selected to participate in the replication project.

The first undertaking was the important process of selecting the next three community colleges, known as the Leader Colleges, to develop and launch a financial coaching program. An RFP was created to competitively select colleges who serve a large percentage of first generation, racially minoritized, and economically disadvantaged students to improve their financial health through behavior change and to increase persistence and graduation rates.

After review of all applications, the following community colleges were selected to join WCC to develop and implement the coaching program at their campuses beginning in the fall of 2022:

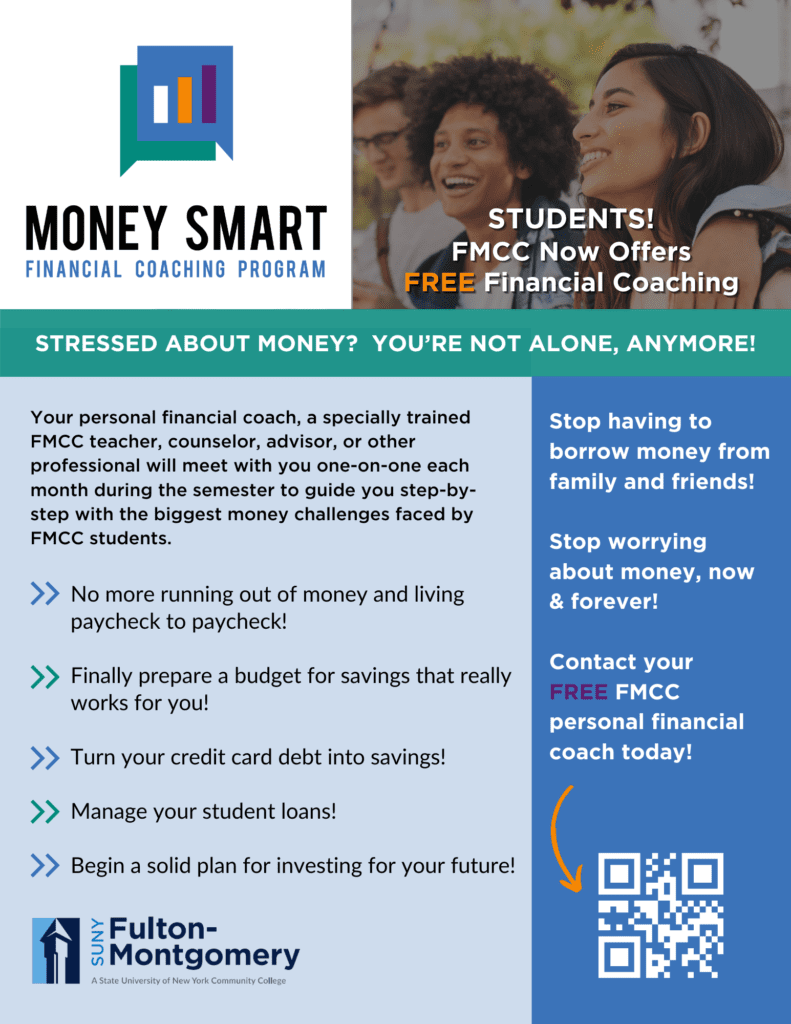

- Fulton-Montgomery Community College (SUNY), Johnstown, NY

- Mott Community College, Flint, MI

- Rockland Community College, (SUNY) Suffern, NY

With the program expanding, it was clear that a standardized system of data collection to measure student outcomes related to the program’s target metrics was critical to the success of the program. Program staff searched for an existing platform and found none that met the specific data needs. Therefore, NCWE hired Winmill Software, a technology services company, to develop an MSFCP database for coaches to enter information, manage data and create various reports related to the target metrics of the program. A MSFCP Database User Guide was developed to provide the colleges instruction for the use of the database. Highly qualified evaluators, Charles Dervarics and Dr. Mary Fowler, were contracted to evaluate the success of the program against the various target metrics and student outcomes.

By the end of the spring 2023 semester, the four colleges collectively served 346 students, with participants showing an average increase in savings of $2,478 and an average decrease in debt of $2,180. Additionally, on average, participants improved their credit scores by 38 points and their average hourly wage by $7.48.

Results from the interim evaluation report indicated that among all MSFCP participants, 79% persisted in college and 76% were retained at their colleges from 2022 to 2023. In addition, an impressive 79% of first-time, full-time (FTFT) MSFCP participants were retained at the college where they began. This finding exceeds the 61% retention rate seen in national data for FTFT students at all public two-year colleges. Regarding credential completion, an average of 27% of the participants in the program completed a certificate or degree during the year.

With a year of success established, the next group of four Learner colleges were selected through a competitive RFP process to begin the program in fall, 2023. These Learner Colleges were:

- Long Island University (LIU), Brooklyn, NY 2

- Monroe Community College (SUNY), Rochester, NY

- Renton Technical College, Renton, Seattle

- Winston-Salem State University (HBCU), Winston-Salem, NC

By the end of the spring 2024 semester, the four colleges together served 249 students, with participants showing an average increase in savings of $2,102 and an average decrease in debt of $492. Additionally, on average, participants improved their credit scores by 40 points.

For the final six months of the program, three additional colleges in the City University of New York (CUNY) were invited to join the evolving MSFCP by setting plans in place to offer a personal finance course along with individualized financial coaching beginning spring 2025. Those colleges are:

- Bronx Community College

- City College of New York

- Medgar Evers College